Your Cart is Empty

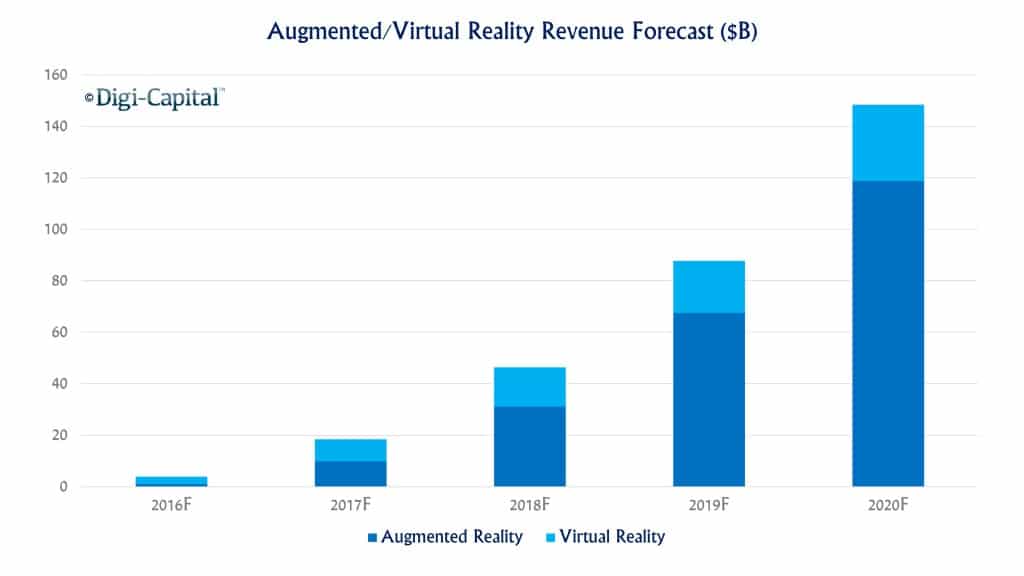

Technology is always helping industries evolve but the last few years have seen AR redefine many stodgy sectors. Though Augmented Reality (AR) has been around for years but it has gained popularity recently after tasting success with Pokemon Go in the gaming world in particular. Analysts forecast the market for augmented/virtual reality could be worth $150 billion by 2020, with augmented reality taking the lion’s share of $120 billion. The traditional financial sector has always has been slow when it comes to adoption of new technology. But the advent of fintech has given us technologies such as Robo- Advisors, Artificial Intelligence in financial markets, biometrics for compliance and KYC etc. AR is the next step in the evolution of finance to fintech.

Growing Phenomena One thing is very clear- the future of our financial services lies in our phones and tablets; the millennial are way too engrossed with technology and their smartphones and going to brick and mortar branches is just not their cup of tea. Therefore it is imperative for financial institutions to incorporate AR technology to engage with the millenials.

Use of AR by Banks Banks around the world have introduced AR-enabled mobile apps in their endeavor to improve customer service. This includes “home finder” apps introduced by Commonwealth Bank of Australia and Halifax in the UK. National Bank of Oman let customers find nearest ATM or branch with the help of AR, there are personal finance management apps that help the customer better envision their accounts. Though these are initial steps but have the potential to transform the financial services industry in the future.

Helping enhance productivity of employees is another area where AR is helping big banks reimagine their current systems of operations. Visual representation of large quantities of data through more intuitive AR interface will help in making important data-driven decisions quickly and accurately. For example, Citibank has started using Microsoft HoloLens headsets to create a holographic workstation for its analysts.

The advent of mobile apps and digital banks has quickly diminished the future value of brick and mortar branches. Millennials can look at products virtually while sitting at their homes and can have a realistic meeting with the bank representative without moving from their couch with the help of AR.

Conclusion The slow, cumbersome and age-old banking industry is the perfect hunting ground for AR. It is an opportune time for the legacy financial institutions to incorporate and implement AR tools. It is not a question of IF but When will AR becomes an integral part of your banking experience. The winners in the next decade will have perfected the art of leveraging AR for selling financial services to their customers. This content is sponsored by Lampix. Visit us at lampix.com.